The Takeaway from Today’s Morning Brief

This is the takeaway from today’s Morning Brief, which you can sign up to receive in your inbox every morning along with valuable insights.

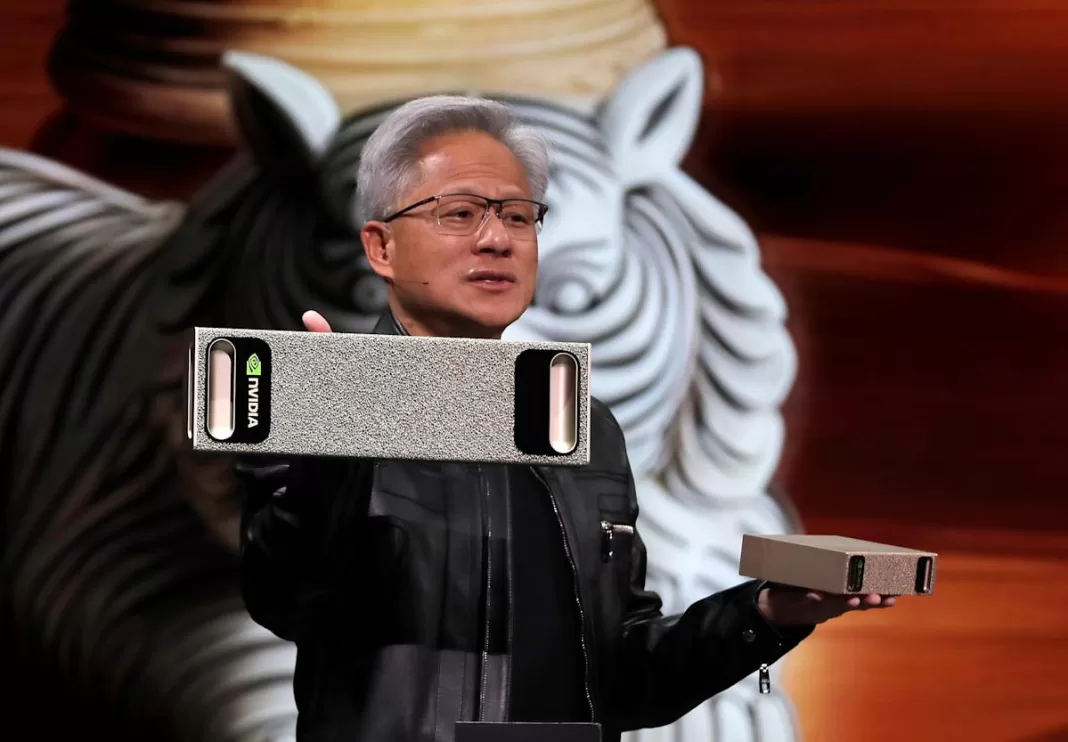

Nvidia’s Stock Setup Ahead of Earnings

As Nvidia (NVDA) approaches its earnings report on Wednesday evening, the setup surrounding its stock leaves me preoccupied. Despite having left my sell-side analyst role over a decade ago, the urge to predict stock reactions after earnings reports still lingers. In this case, I’m genuinely perplexed about how the market will respond; there are indications that investors may react negatively.

Concerns Over Gross Profit Margins

Nvidia is navigating through a phase where gross profit margins are compressing, primarily due to the introduction of its Blackwell chips. Investors and analysts are keenly awaiting guidance regarding management’s confidence in a potential recovery of these margins. Nvidia previously targeted mid-70% levels for gross margins in the latter half of the year. However, given the backdrop of economic challenges, I’m uncertain if the company can provide that level of reassurance. It’s conceivable that they might suggest a ramp-up to over 70%, but doing so could risk disappointing investors—a scenario fraught with pitfalls.

Impact of H20 Chip Ban on Earnings Guidance

In addition to margin concerns, Nvidia’s upcoming second-quarter sales and earnings guidance might present an unexpected challenge. The management team is likely to account for the impacts of the H20 chip ban imposed on China. While analysts have been preparing for this change, having adjusted EPS estimates downward over the last 60 days, they might still be underestimating the top-line reductions this ban could bring about.

Market Sentiment and Potential Catalysts

According to a note from BofA semiconductor analyst Vivek Arya, there’s a necessity for Nvidia’s stock to find a positive catalyst, such as increased visibility into 2026 plans, gross margin recovery, or new product launches targeted at the Chinese market. These factors could drive the stock’s appreciation in the near term.

Nvidia’s Valuation: Analyzing the P/E Ratio

The valuation of Nvidia from a price-to-earnings (P/E) perspective raises intriguing questions. On one hand, considering the company’s substantial long-term growth potential, it may appear relatively inexpensive. Conversely, given the aforementioned factors, the current valuation might also seem overvalued, leading to a complex evaluation for investors.

Insights from Industry Experts

Ahead of the earnings report, I’ve consulted with several industry insiders who provided insights regarding Nvidia’s P/E ratio. Their expertise can shed light on how it might influence market expectations moving forward. Their observations challenge the traditional metrics often used to evaluate stocks.

Understanding Growth Potential and Market Skepticism

One perspective emphasizes that evaluating Nvidia solely based on a simplistic P/E ratio may not effectively capture its long-term growth prospects. Analysts suggest that a PEG (price-to-earnings growth) ratio could better reflect the multi-year opportunities available, particularly in areas like data centers and AI infrastructure growth.

Market Skepticism and Stock Price Dynamics

Some believe that the relatively low P/E of Nvidia signifies a broader market skepticism surrounding the company’s capacity to maintain its impressive revenue growth rates. Comparatively, there is a perception that Palantir may have better growth potential in the future, making the market cautious about Nvidia’s immediate capability to reproduce outstanding results.

Long-Term Earnings Outlook

Despite Nvidia’s consistent performance in meeting earnings expectations, there has yet to be a significant surge in its stock price. Some analysts believe that renewed interest in Blackwell could potentially push the stock back to previous levels around $140 to $150, but it would require a robust performance to change current market perceptions.

Valuation in Today’s Tech Market

Nvidia’s profits and sales are increasing at a remarkable rate. For those who believe in the sustainability of these growth rates, the stock appears to be undervalued. Remarkably, Nvidia’s shares have surged by 42% year-over-year, yet the price-earnings and price-sales ratios have remained relatively constant, showcasing its stability amidst growth.

Defining Value: Subjective Perspectives

Value is often subjective, and perceptions of Nvidia as a ‘cheap’ stock may stem from its substantial brand strength. Investors may categorize Nvidia as the most accessible option among its peers despite its competitive valuation in contrast to other technology stocks. Consequently, Nvidia’s trading price of $130 seems more appealing compared to that of giants like Meta and Microsoft.

Conclusion: Navigating the Earnings Landscape

As Nvidia approaches its earnings report, the market anticipation is palpable. The challenges surrounding profit margins, sales guidance, and overall sentiment will be critical elements influencing investor behavior. Observers will closely watch for any new information that may shift the narrative, whether positive or otherwise. Understanding these dynamics is essential for making informed investment decisions in the potentially volatile environment surrounding Nvidia’s stock.