The Big Find: Norway Strikes Oil in the North Sea

You know how they say the best things come when you least expect them? Well, Norway’s just gone and done it—making one of the biggest oil discoveries in the North Sea in over a decade! Yep, that’s right! Aker BP, the oil field operator, has uncovered a field that’s got the potential to yield a whopping 134 million barrels of oil. Just when everyone thought the area had been picked dry, here comes this surprise. Talk about turning heads!

Picture this: the Yggdrasil field, where all the magic’s happening, is not just any spot on the map. It sits close to the UK sector, bringing up all sorts of questions about energy strategies and decisions. I can’t help but think of those moments when you finally find that last slice of pizza in the fridge—total game changer! It’s like, were we all just overlooking what was right in front of us?

Karl Johnny Hersvik, the head honcho at Aker BP, doesn’t seem too surprised about it either. He called this find among the largest in Norway in a decade. He’s even got a shiny outlook for the future, saying he’s expecting even more discoveries as new tech opens doors we didn’t even know existed. I wonder how many more “slice of pizza” moments are lurking out there.

A Contrast Between Nations

This discovery isn’t just exciting news for Norway—it throws a spotlight on the diverging paths of Norway and the UK in terms of fossil fuel exploration. Norway seems to be riding a wave of success, discovering fresh oil and gas reserves in what everyone thought was a mature territory. Meanwhile, the UK’s playing the waiting game, essentially shutting down new licenses for fossil fuel production. It’s like Norway’s throwing a party, and the UK just decided to sit at home watching Netflix. Talk about a bummer!

It’s hard not to roll your eyes sometimes. Consider this: while Norway’s oil production hit a peak not seen in over ten years, the UK is predicted to see 70% of its output drop in just the next five years. That’s a massive difference! There’s a part of me that wonders what the UK is thinking, kinda like missing out on a concert you really wanted to see. Regret much?

It’s fairly common knowledge that Norway has a pretty favorable setup for oil exploration—supportive government policies, less tax hassle, you name it. On the flip side, the UK’s heavy tax on oil and gas profits has made it all feel a bit more hostile for companies looking to invest. Why fix what ain’t broken, right? Still, here we are.

Taxing Times for the UK

You have to feel for the folks in the UK’s energy sector. With a windfall tax sitting at a staggering 78%, many companies are already indicating that they might pull back on production. Just think about it. If you were in their shoes, would you stick around when profits are taxed so heavily? I definitely wouldn’t hang around for long!

Ed Miliband, who serves as the Energy Secretary, made the decision last year to halt issuing new licenses. For some, it’s a step towards a greener future. For others? It’s like throwing away a winning lottery ticket. All those billions of barrels just sitting there waiting to be tapped feels a bit like a dream deferred. Kind of poetic, but also frustrating!

Ashley Kelty of Panmure Liberum investment bank had some pretty strong words to share. He mentioned that it’s Norway’s consistent government support that has made the difference, while the UK continues to change its tax policies. It’s like trying to build a sandcastle in the waves—it just keeps getting washed away. Why can’t the UK pick how it wants to play already?

Aker BP’s Plans: The Future Looks Bright

So, what’s next for Aker BP? Oh, it’s all go-go-go! They’re planning to drill 55 wells and build new processing platforms plus pipelines for exports. It’s not just about tapping the oil; they’re diving headfirst into creating jobs and pumping spectacular amounts into the local economy. Can you imagine the boom it’ll create for those young folks just stepping into the workforce?

I have to say, it feels refreshing to hear about new job opportunities instead of layoffs. Aker’s expansion plans are expected to generate work for six different shipyards and suppliers across Norway. All those jobs on the line makes you appreciate the effort that goes into keeping the economy rolling. It’s a far cry from the job cuts and facility shutdowns happening in the UK. Honestly, it’s a classic underdog story that’s unfolding right in front of our eyes.

Speaking of local economies, Norway’s got about 90 fields in production. That’s right—67 in the North Sea! Just imagine how those communities are benefiting from this oil boom. Back home, I remember how one small factory in my hometown changed lives. An uptick in jobs means more than simple paychecks; it also means more bouncing kids at local playgrounds or bustling cafes on weekends. There’s a certain energy that comes with economic growth!

Import vs. Export: The Gas Dilemma

Here’s where it gets interesting. Oil and gas from Norwegian fields might soon be making their way back to the UK. In 2024, the UK dropped about £20 billion on fossil fuel imports from Norway, becoming their main gas supplier. Who knew they’d need to rely so heavily on a neighbor they’re not exactly vibing with about energy policies?

Dan Slater, an energy analyst, bluntly states that if the UK doesn’t shift its government policies, they’ll find themselves increasingly dependent on imports. Talk about a reality check! I mean, come on—it feels a bit like a football team that stops playing to focus only on defense, then wonders why they keep losing. The old saying “you gotta play to win” rings ever true here.

Ok, imagine a future where the UK is solely reliant on imports. Wouldn’t that make you scratch your head? The fact is, demand for oil and gas isn’t going anywhere. It’s still a necessity, whether some people want to admit it or not. The world runs on energy, and while we’re working towards renewables, we still haven’t hit the nail on the head yet.

The Renewable Energy Debate

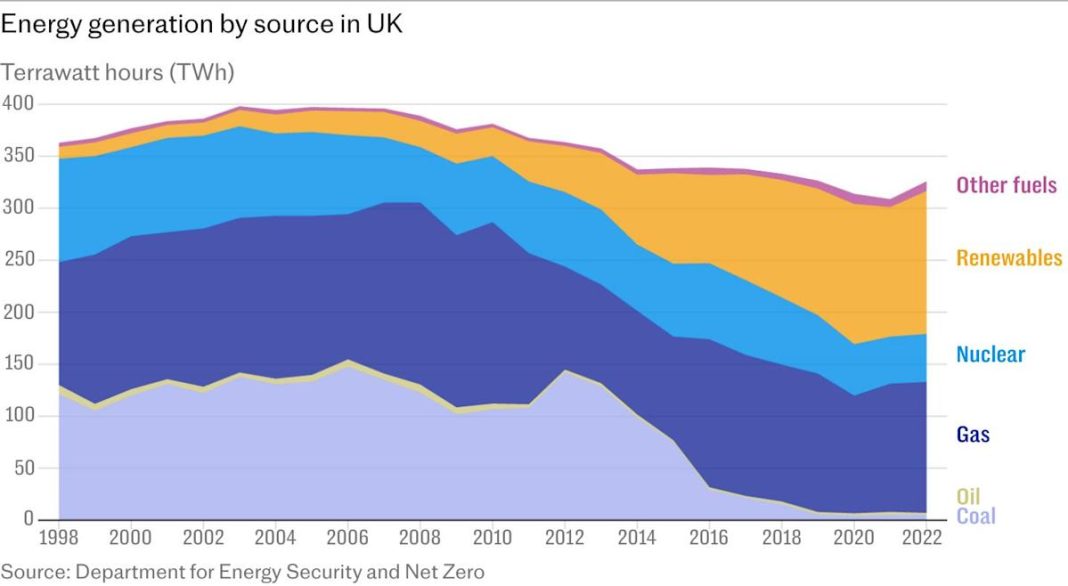

During all this chatter about oil, there’s another angle to consider: renewables. Tessa Khan, executive director of the campaign group Uplift, believes Britain should be doubling down on renewable energy sources. She argues we’ve hit the ceiling regarding fossil fuels in the UK, and we need to pivot. I can see where she’s coming from. It’s like reallocating funds after a failed investment and deciding to chase something you know will actually pay off.

Let’s take a detour for a moment, shall we? I remember visiting a friend who’d transformed their back garden into a mini solar farm. They were all about sustainability and had completely ditched fossil fuels. Watching their excitement about being part of the greener change left me thoughtful. Wouldn’t it be great to reach a point where clean energy stands as the norm rather than the exception?

Yet, the perpetual question remains: has the UK really exhausted its fossil fuel reserves? Ms. Khan argues that after 60 years of drilling, the majority of what was available is burned through. I can’t help but nod along, pondering the balance we need to find. The future demands consideration—not just of what we can dig out of the earth but how we can harness the natural world around us.

FAQs About the Discovery

What happens next for Aker BP?

Aker BP is gearing up for action! They’re planning to drill 55 new wells and build processing platforms. It’s an exciting time for the company, pushing the boundaries of what’s possible!

Why is Norway doing so well economically compared to the UK?

Norway’s supportive government policies and a stable tax regime have fostered a thriving environment for oil exploration. On the flip side, the UK’s heavy taxation and restrictive policies are slowing down investment.

How can this discovery impact UK’s energy security?

If the UK continues to limit fossil fuel exploration and production, it may become increasingly dependent on imports, particularly from Norway. This could have wider implications for the country’s energy security and economy.

Are there any job prospects opening in Norway?

Absolutely! With Aker BP’s expansion plans, numerous jobs are set to pop up in various shipyards and sectors. It’s a promising time for job seekers looking to get into the energy industry in Norway.

What’s the long-term outlook for UK fossil fuel production?

The outlook isn’t great unless policies shift. The UK is projected to see a significant drop in output, and it remains to be seen how the government plans to balance domestic production with the ongoing reliance on imports.

Conclusion: A Fork in the Road

<p So, what’s the open road look like? On one hand, Norway is charging ahead, discovering new oil fields, creating jobs, and enhancing their energy independence. Meanwhile, the UK is taking a detour, focusing on taxing fossil fuel production while they possibly overlook lucrative resources below the seabed. It's like watching a race where one car takes the highway while the other chooses backroads.

Instead of declaring winners just yet, we’ve got to keep an eye on what both countries do next. Will the UK adapt and change, or will it continue its current trend? I guess we’ll find out, but for now, here’s to hoping for some common sense and progress in energy production!