Brace Yourself: Health Insurance Rate Hikes on the Horizon

If you’re one of those North Carolinians who buys health insurance through the Affordable Care Act marketplace, then you might want to start stashing away some cash. We’re talking about serious rate hikes coming your way in the next year that could hit your wallet hard.

Since the signing of the “One Big Beautiful Bill Act” by former President Donald Trump, more details are coming into focus about what that means for your monthly expenses. One major takeaway from the bill? The Republicans in Congress chose not to extend those tax credits that kept health insurance payments relatively low for a lot of folks—a decision that’s stirring up quite a storm!

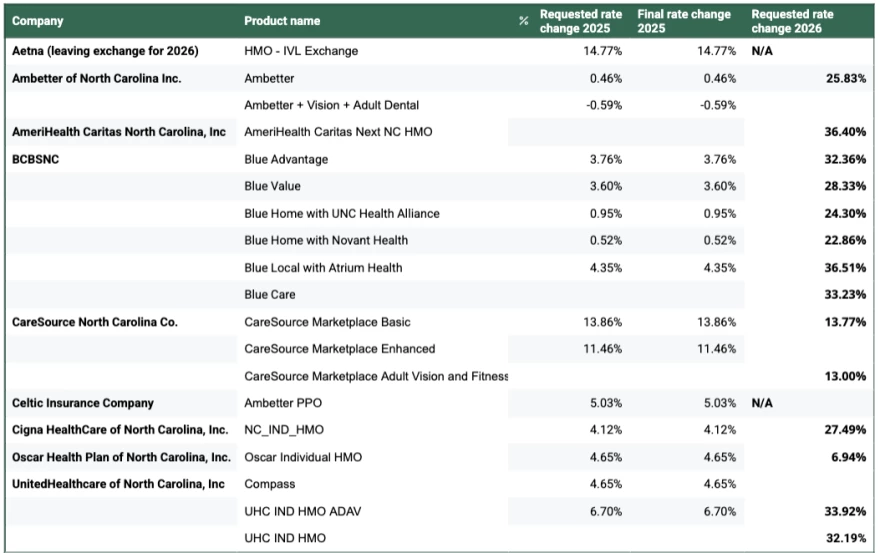

Insurance companies in North Carolina have already put in requests for rate increases ranging from 6.9% to a jaw-dropping 36.5%. If that doesn’t scream “buckle up,” I don’t know what does. This isn’t just your typical price hike; it’s the largest spike we’ve seen in five years!

What’s Behind These Hikes?

Okay, so why is this happening? Well, like most things these days, inflation is playing a big role. Prices are climbing everywhere. Plus, new and expensive drugs, like Ozempic, are pushing healthcare costs to ever higher limits. Concerns are brewing about tariffs that could also jack up medication prices.

Millions of consumers are about to feel this pinch. Many have been paying artificially low premiums thanks to tax credits put in place during the pandemic. These tax breaks kept costs down, helping about 26 million folks sign up for insurance this year.

Remember that Wake County example I mentioned? A 50-year-old making about $40,000 a year pays, on average, just $154 a month for insurance. That’s a sweet deal. But expect that to change—big time. With no more tax credits, they’ll see their premiums jump to around $258/month! It’s a world of difference.

The Reality for Many North Carolinians

With about 1 million people in North Carolina relying on the marketplace for their insurance, these changes are about to hit home—and hard. Local analysts predict a major drop in those buying marketplace plans next year, with possibly fewer than 634,204 folks signing up!

A friend of mine, Lydia, who’s a single mom working in food service, has been feeling the heat. She managed to snag a Blue Cross plan for $50 a month earlier this year, which felt like a lifesaver. But now, she’s worried about what this new pricing structure will mean for her and her child.

“I’m just taking it day-to-day,” Lydia told me. “It feels overwhelming, knowing my insurance might become unaffordable.” And honestly, who can blame her? Health secure for her kid is essential, but with these rising costs, her stress levels are sky-high.

Dropping Out: Healthy Folks vs. Those Who Really Need Coverage

The intriguing thing is that insurance companies know that when rates go up, healthier people tend to drop out first—and that makes everything more expensive for the rest of us. It’s like a vicious cycle. The people left are often those who really need coverage, like people fighting chronic illnesses or those undergoing treatment.

If all of those healthy folks bail on the marketplace, what happens next? Everyone left pays higher premiums. It’s a domino effect, man! And you know what’s scary? When sick folks show up in emergency rooms unable to pay, hospitals have to pass those costs down the line. And guess who’s footing the bill? Yup, you guessed it—everyone who’s still insured.

Just like a rollercoaster, the ride can get bumpy, and it’s not just about individual health plans; it impacts the whole collective insurance market.

FAQ: What’s Really Happening with ACA Rates?

Why are rates going up so much in 2026?

Rates are increasing due to the expiration of tax credits that kept premiums low, inflation overall, and rising costs of newer medications. Insurance companies are trying to maintain their revenue levels amid falling enrollment pools.

What should I do if I can’t afford the new premiums?

Explore other options, like federally qualified health centers or charity programs that assist with lower-cost drugs. It’s vital to stay informed about what you can do to keep your health coverage within reach.

How can I avoid dropping my coverage?

Stay engaged and look for potential alternatives that may offer insurance options fitting your budget. It’s worth checking out out-of-pocket assistance programs or community health services.

Who is affected by these changes?

It’s not just a few folks—it affects the majority of those using the ACA marketplace in North Carolina. Given that many are older adults with chronic conditions, the changes will hit the most vulnerable populations especially hard.

What’s Next for Insurers and You?

The insurance companies are making moves to accommodate these changes. They’re forecasting fewer enrollees in the marketplace, creating an environment where prices will inevitably climb as fewer healthy people remain. It’s a numbers game, and right now, the ballpark doesn’t look good for consumers.

Before all the chaos settled, national analysts were estimating average monthly premiums to soar to about $670 per person in North Carolina for 2026. That’s hefty! And when you take away the tax breaks, even out-of-pocket expenses could shoot up significantly.

“When it’s expensive, younger folks tend to drop out,” said Nicholas Riggs from the NC Navigator Consortium. “That only complicates the risk pool for insurance.” And it’s true; when folks who need care stay in the pool but the healthy ones leave, we’re all looking at those higher premiums.

A Ripple Effect Beyond the Marketplace

If you think these changes are only affecting those on the ACA marketplace, think again. Analysts predict that everyone, including folks not buying through the marketplace, will likely see a rise in health insurance costs, thanks to the interconnectedness of the insurance market.

The ACA marketplace relies on a good mix of healthy members to function optimally. If healthy folks drop out, it’s going to impact everyone’s fate. When hospitals end up with more uncompensated care, those costs trickle down through the entire system, putting the pinch on every insured person out there.

Local areas, especially rural communities, are projected to get hit the hardest. Less access to healthcare options means folks in those regions might really feel the squeeze when it comes to premiums and available services.

Final Thoughts: Sticking Through Challenges

It’s a tough time for many watching health coverage become ever costlier. Like definitely scarier than a horror flick! People are anxious, and that’s understandable. Lydia’s situation is just one of many out there, where individuals are faced with hard choices.

Riggs has indicated a shift in focus towards community health resources, urging people to look for alternative options as enrollment periods approach. “We’re diving deep to help folks find what they need,” he mentioned.

As consumers brace for changes and uncertainties ahead, it’s vital to stay informed and proactive. Navigating the ACA landscape can be like choosing a dish from an overwhelming menu—confusing, frustrating, and, at times, downright scary! But by keeping an ear to the ground and utilizing available resources, it’s still possible to weather the storm and secure the coverage that’s necessary.